Explore the caution Signs that shows condo can be a bad investment

Investing in a condo is quite an easy process and affordable as well, but it is not always possible that the condo you are buying is always a good choice. In condos, the buyer invests in a particular unit, but with that unit comes the responsibility of the condo complex. Residents have to share some common areas with neighbors, and this brings that responsibility. It is good to know more about condos from a lawyer and include the condition named Status Certificate in the purchase agreement of the condo. This document is helpful for the lawyer to get you a chance to scope out the issues, whether they are financial or legal related go the condo unit.

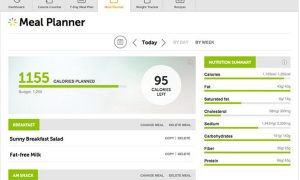

Before fixing the deal, it is imperative to know what you are dealing with and see all the warning signs that could make the condo a bad investment. Sometimes, people who think of investing in homes are a good choice, and you can check Ola EC showflat to know more about housing investment. Here in this article, we will know about some of the warning signs that show condo you are interested in is a bad buy for you:-

- Lingering special assessments

The special assessments are charged by the corporation of the condos on the owners, which are mainly for paying out to do the major expenses for the repairs which ate not covered under the reserve fund. If the major repairs are to be done, then owners of the condo units have to pay some money other than the charges they pay monthly to carry out the repairs. The buyers looking for the condo units must check about the special assessments and must avoid if the charges keep on increasing.

- Scarce parking spots

There are some condo communities that fail in making the parking spots available for every resident. Before investing in, it is imperative to look for the parking areas and know if there is free space for parking your vehicle if you invest in a condo. If there are scarce parking spots then avoid investing in such places.

- Outdated Status Certificate

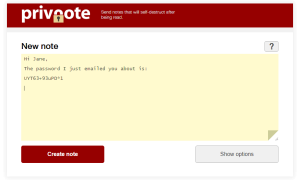

Before investing, the buyers must know from the lawyer about the Status Certificate and check if it is up-to-date. It happens many times that the content is outdated of the Status Certificate, and in this case, it is not good to invest in such condos. Get to know about the certificate and know if it is complete and accurate and then think of investing in it. It is better to invest in condos that have upgraded their Status Certificate and are following the rules appropriately.

- Much needed repairs and maintenance

If the repairs of the condo community are never-ending, then this is a bad sign, and you must not invest in it. There can be multiple issues that can result in the aging of the building and needed to make big repairs. Check and know if the condo community makes repairs often or not, and if the community is not making repairs for a long period of time, then a buyer must not invest in such condos.

- Looming lawsuits

Check the status certificate and know in detail if there are any pending lawsuits for the condo. The pending lawsuits will end up paying money by the owners, and if there are any, then you must not prefer such condos in any situation. It is imperative to do great homework and know everything about the condo that you are going to invest in. This is a smart move and will save you from investing in the wrong place.

Condos are like apartments but are a little different. It is good to make investments but by doing good homework. You must contact your friends or family if they have invested in condos and know about the factors that are important to consider before investing in a condo. Also, you can know about the warning signs that must be checked before investing, which mainly shows that the condo you are about to buy is not a good investment. It is good to save your hard-earned money than on spending on a condo which is not worth investing on.