A Beginner’s Guide to PayDay Loans briefly! Read to know

Pictures this, your car just broke down and you need $300 to get it out of the shop. What do you do if you don’t have any money set aside, poor credit and you can’t go without a car until you get your next pay check? Well, a payday loan is one possible solution, but you should know what you are getting into.

Not a Long Term Solution

Payday loan companies have wording in their contracts that states that a payday loan is a short term financial solution and not intended to be a long term debt solution, they just want to have all the personal loan information, which a customer has taken in past to provide them with best schemes. The disclaimer is required by law. The reason is because the longer you have your payday loan; the more you’ll pay in interest.

Extremely High Interest Rates

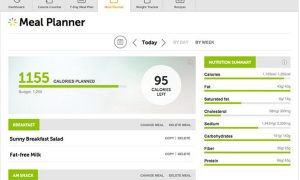

Interest rates for payday loans are roughly between $15 – $30 or more per term for every one hundred dollars you borrow. A term is defined by the amount of time between pay periods. Policies for the time frame between when you first take out your loan and when your first payment is due varies between companies.

Pay More than the Interest

Payday loans can become a vicious cycle for some people. If they get their next paycheck and all they can pay is the interest payment due, then the loan rolls over and continues to accrue interest. If you can’t pay the loan in full, at least pay more than the interest so that your principal goes down. As you pay down the principal loan, the interest rate drops as well.

Don’t Get Trapped

Even though most states have laws that limit how long a payday loan can be renewed, payday loan companies have ways of working around these laws. They may only allow you to pay the minimum interest payment for 3 months before you have to pay off the entire loan, but you can go in with your full paycheck and pay off the loan. After that they will give you a new loan on the spot; which is the same as making an interest only payment.

Never Double Up

If a pay day loan customer has trouble paying the minimal interest payment, he or she may borrow money from another payday loan company in order to make the payment. Well, unless you can borrow enough to pay off your first loan in full, then next pay period you’ll have two payday loans due instead of one. Even if you can borrow enough to pay off the first loan, you’ll end up paying more on the newer loan because it’ll likely be higher than your original loan was.

If you let them, payday loans can continue for years and you end up paying a small fortune in interest. You can also potentially get yourself in way over your head financially if you take out multiple payday loans. Payday loans should be used for emergencies only and, just as the name suggests, you should try your best not to keep any payday loan longer than one pay period.