Choosing Bad Credit Auto Lenders

Everyone experiences financial problems during their lifetime. Quite a few are, however, less fortunate than the rest. Money has never been easy to find, and it is even more so nowadays amid economic hardships a result of the recession. Financial problems can be by means of drowning in debt, possessing bad credit standing, or perhaps worst of all scenarios bankruptcy. Nonetheless, cars certainly are a need in everyday life. There are many people that can’t go without them as they do not have access to good public transit. In such situations, not having cars causes it to be hard to get anything accomplished. While it’s true most companies loathe needing to lend people who have poor credit standing, bad credit auto lenders are available. You find the Updated List of Licensed Money Lender as you click here. This way you can connect with some of the best and credible money lenders in your area.

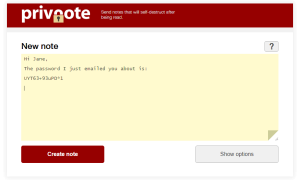

There are numerous car loans for bad credit offered to consumers online looking to purchase a vehicle. These lenders offering poor credit auto loans online are generally really well- connected to independent auto loan companies, and help them in providing auto loan financing. Such firms are also connected to car dealers and these contacts give clients more options concerning what type of cars they could get at good price ranges.

There are particular things though that set apart the normal car loans for bad credit lenders and the best ones. One of those factors is the speed of processing time. There’s a variety of reasons why fast processing is critical for clients needing poor credit auto loans. Some are listed below:

Not having all the time in the world

Although this is self-evident to most, bad credit customers will relate even more to this. This is a world where credit drives consumption, and poor credit standing detrimentally impacts a person’s quality of life. An individual coping with a mountain of debts is constantly stressing about how to pay their debts. To do that, they need work to obtain the funds. Consequently, they can’t afford to take a lot of time off their work to have their applications processed for these loans simply because they can lose their jobs, which makes paying much more difficult.

Moving into a location in which the only way to get around is a car

Even though the world is very urbanized nowadays, there are lots of locales where people don’t have good public transit systems, which makes using a car as the only way to get around effectively. There’s an urgency to acquire one quickly in such instances simply because daily life is a hardship, and walking far or waiting for spotty transport services can be an additional problem. It may also be unsafe because of several personal issues of safety.

There are numerous more reasons that demonstrate why individuals would prefer to have poor credit auto loan lenders that provide fast services to clients.

Public transit systems are not something everybody has that is why people need cars. Time and money, however, are not luxuries that can be wasted, and that’s why it is recommended that people (particularly those with poor credit standing) can get loans from bad credit auto lenders. The quicker, the better, and there are lots of websites that could offer these in minutes. Anybody who can’t wait or go through the typical headaches has options and need not wait.

Ronnie Brown is a financing expert who has worked with many bad credit auto lenders. For more information concerning how to get the best auto financers read up more about car loans for bad credit services.