How to Negotiate and Purchase a Personal Insurance Plan

As freelancers, my wife and I do not enjoy convenient insurance benefits from employers. Therefore, we frequently review our personal insurance plan and make changes according to our lifestyle. When you have to shop for all different types of coverage, it pays to be prepared.

A personal insurance plan can include a variety of insurance products, and is designed to cover you and your family in a wide range of circumstances. Common products purchased with a personal insurance plan include life, health, dental, vision, personal property, long term care, auto, disability and home insurance.

One of the most common reasons to negotiate and purchase a personal insurance plan is when you do not have insurance benefits through your employer. Perhaps you’ve started your own business or maybe you’ve decided to go back to school; either way, you can save significant cash by initiating a plan.

Decide Which Products You Need

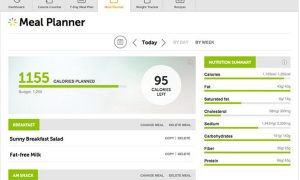

The first step to purchase a personal insurance plan is to decide exactly which products you need. This will help keep you focused and within budget, and will protect you from the sales tactics of insurance agents. Make a list of the different types of coverage you require. It is important also to try car insurance that fits around you. You must know what are the coverages of the policies and you must be very careful with all of the factors to consider.

Once you’ve compiled this list, you can research different insurance companies to find out which ones carry all the products you need. A personal insurance plan saves you money because you obtain a discount for purchasing all products from the same company, so this step is essential.

Avoid Duplication

The biggest mistake you can make when you purchase a personal insurance plan is double up unnecessarily on coverage. For example, personal injury protection in car insurance often covers what health insurance already provides. You’ll be paying money for a service you don’t need.Cut out any insurance products or coverage types that will cost you extra money from duplication. You can ask your insurance agent to point these out, but it helps if you go over the details beforehand.

Make Your Case

Never visit your insurance agent without preparing yourself in advance. Know the discounts you should be eligible for and the details about any property you want to cover. Expensive items might require appraisals, and you should know the safety features of your home and car because they might make you eligible for additional discounts.

After your insurance agent has issued a preliminary quote on your personal insurance plan, go over the details line by line to find out if you can save any more money. Let the agent know if you are talking with several different companies (only if you actually are) because competition often results in discounts.

Compare the Options

Don’t make a decision in your insurance agent’s office. Take home the quotes and review your options in private, or with a trusted friend or relative. Impulsive buys are often mistakes when it comes to personal insurance plans.

Give yourself the opportunity to explore multiple quotes before making a decision. Insurance can be expensive, and you don’t want to overpay for products you could find elsewhere for less.